The rate of UAE AED to INR is important for people who travel or work in India. Learning how to make the UAE dirham to Indian rupee conversion ensures that one takes on business ventures that yield high profits with low associated risks.

As one of India’s largest trade partners, UAE currency rates have a strong business impact, such as export India. The blog will discuss the changes and consequences on trade and remittances and on the behalf of the factors concerning UAE dirham to INR rate. This emphasizes the need for UAE trade with India and the fact that bilateral economic connections are greatly shaped by currency rates.

What is the UAE AED to INR Exchange Rate?

An exchange rate of 4.8 Indian Rupees for 1 UAE AED to INR is standard with fluctuations based on supply, demand, inflation indices, and interest rates, as well as particular currency purchasing and selling. The exchange rate determines the value of the UAE Dirham in relation to the Indian Rupee.

The change of currency driven by purchasing or selling from a country is called an INR AED exchange rate. Like all quotes of currency shifts, this is significant to Indian traders. Businesses and people should carefully follow the rate to maximize trade revenue alongside reputable monetary decisions and investments.

Importance of the AED to INR Exchange Rate in Trade

Export India is significantly supported by the exchange rate of UAE AED to INR. While exporters may have to pay more for imports and suffer reduced returns if the exchange rate is unfavorable, if it is favorable they can maximize their revenues.

- Exporters: Indian exporters need to track the UAE dirham to INR rate as it is crucial for calculating product prices for which they compete internationally.

- Importers: Indian importers dealing with the UAE will have to manage costs related to constant movement in the exchange rate.

- Investors: Investors operating in both markets have to consider the changing rates of currency in respect to the final returns.

Effective planning of trade activities can be achieved by a good understanding of the trade from UAE AED to INR.

Conversion Methods: UAE Dirham to Indian Rupee

UAE dirham to Indian rupee conversion can be conducted through a host of systems these days, both from financial institutions and the internet.

How to switch currencies from UAE Dirham to Indian Rupees:

- Bank Services: Banks can convert foreign currency, but as with everything, it comes at a price.

- Money Exchange Services: Authorised money exchange centres set up in major cities have better rates and charge less.

- Online Platforms: Many websites and mobile apps provide real time updates on UAE dirham to INR rate and currency switching within seconds.

This practice helps you avoid risks associated with trading by selecting a scheme that provides the best prospects for UAE dirham to Indian rupee conversion.

How to Calculate the INR AED Exchange Rate

The calculation for the INR AED exchange rate can be done easily. You only need to solve the given equation.

INR Amount = AED Amount x Current UAE AED to INR Rate

For instance, converting 50 AED to INR, assuming 1 AED is 20 INR, goes like this:

50 x 20 = 1000 INR

Calculators available over the worldwide web are programmed to give exact figures and can get the required market rate on UAE Dirham to Indian Rupee conversion.

| Exchange Query | Equivalent INR |

| 1100 AED to Indian Rupees | 24,200.00 |

| 1400 AED in Indian Rupees | 30,800.00 |

| 7000 AED to Indian Rupees | 154,000.00 |

| 1300 Dirhams in Rupees | 28,600.00 |

| 1999 Dirham in Indian Rupees | 43,978.00 |

| 6000 Dirhams in Indian Rupees | 132,000.00 |

Impact of Currency Fluctuations on Trade

Trade relations between India and UAE can be impacted by exchange rates owing to their fluctuating nature. High AED value against INR translates into unfavorable competition for Indian merchants due to the price of Indian goods in the AED market.

On the other hand, a low AED value would help Indian retailers. Regular traders in the Indian market should be aware of continuously shifting currency rates to balance their expenses and profits. Forward contracts enable one to get a good transaction rate and so help to secure something.

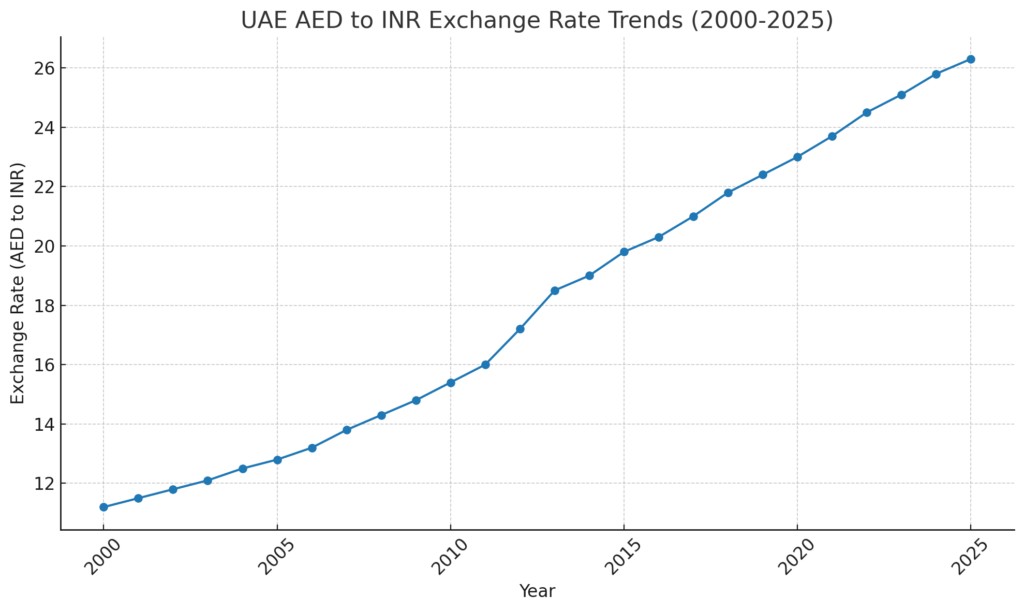

Long-Term Trends: Exchange Rates of UAE AED with INR from 2000 to 2025

Through all the years, the UAE AED to INR rate is primarily dependent on interconnected economic, geopolitical, and market forces, which have caused sharp fluctuations.

Historical Trends: UAE AED to INR Exchange Rate (2000-2025)

- 2000-2008: There was no significant change in the exchange rate, though there was some due to the increase in the global economy.

- 2008-2009: The exchange rate became unstable because of the global financial crisis.

- 2013-2015: There was an increase in the exchange rate because of economic overhaul and inflation in India.

- 2020: The energy of the pandemic was felt everywhere, resulting in economic shocks to all countries, and so changes in currencies were experienced.

- 2021-2025: Friendlier exchange rates emerged from the phases of stability and restoration of the markets.

These tendencies enable rate change prediction, so they are very important for comprehending trade-related company plans.

Remittances and the Role of Exchange Rates

The value of remittances from expatriates working in the UAE is highly dependent on the UAE dirham to INR rate. For Indian expatriates, a high rate helps since it facilitates more money sending.

Top tips for remittance transactions:

- Check multiple platforms to ensure you are getting asked the best rates.

- Avoid putting through transactions during times when volatility is high off the market.

- One should make advantage of dependable systems charging less transaction fees.

Expatriates can maximize their remittance value by staying informed about the UAE AED to INR rate.

Future Trends in UAE AED to INR Exchange Rate

Several factors dictate the future trends for the UAE AED to INR exchange rate.

- Worldwide Economic Trends: Currency strength is affected by inflation rates, interest rates and even the GDP.

- Geopolitical events: Foreign policy relations between India and the UAE shaped their political stability and trade relations.

- Technological advancements: The introduction of digital currencies along with the emergence of payment platforms will have ripple effects on the current market exchange rates.

These factors will play an important role in determining the economic policies for businesses and investors.

Impact on Indian Exports to UAE

The INR AED exchange currency pair has an impact on the Export India business. An advantageous currency rate makes it possible for the Indian exporters to sell their goods in the UAE profitably.

How to Succeed:

- Track currency exchange rate transactions.

- Utilize forward exchange contracts to protect against adverse exchange rate movements.

- Real price changes are necessary market economics and Its impact on the changing global order.

By utilizing these methods in the trade, Indian exporters will be able to increase their trade earnings.

Conclusion

Understanding the relationship between the exchange rates between UAE AED to INR, rupees, as well as INR, is essential for business, expatriates, and travelers. This will allow them to make informed decisions regarding trade, remittances, and other impacts of currency exchange economics. Regardless if you participate in Export India, remittances, or investment activities, it is critical to try and understand the forces that drive these currency exchange rates to improve financial outcomes. Contact us to stay informed and make better financial decisions in global trade and investments.